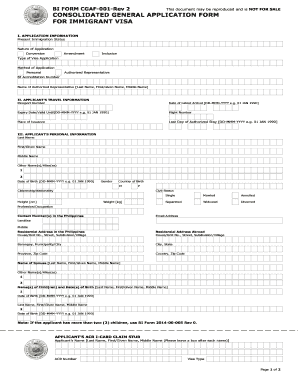

PH BI Form CGAF-001 2019-2025 free printable template

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bi cgaf 001 form

Edit your bi form cgaf 001 rev 2 sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bi general application immigrant form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cgaf 001 general form online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bi cgaf 001 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH BI Form CGAF-001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out cgaf 001 application form

How to fill out PH BI Form CGAF-001

01

Obtain the PH BI Form CGAF-001 from the official website or at an immigration office.

02

Read the instructions carefully before filling out the form.

03

Provide your personal information in the required fields, such as your name, nationality, and date of birth.

04

Fill in your contact details, including your address and phone number.

05

Indicate the reason for your application or request on the form.

06

Attach any necessary documents or identification as specified in the instructions.

07

Review your completed form for any errors or missing information.

08

Sign and date the form as required.

09

Submit the form either online or in-person to the designated office, along with any applicable fees.

Who needs PH BI Form CGAF-001?

01

Individuals seeking a visa or other immigration services in the Philippines.

02

Applicants applying for a special permit or residency in the Philippines.

03

Foreign nationals who need to report to the Bureau of Immigration.

Fill

cgaf 001 consolidated application form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file bi form cgaf 001?

The bi form cgaf 001 must be filed by all employers and self-employed individuals who are required to pay taxes to the Internal Revenue Service (IRS).

How to fill out bi form cgaf 001?

To fill out a bi form cgaf 001, you will need to provide information about yourself, including name, address, date of birth, social security number, citizenship status, and any other information requested. You will also need to provide proof of identity, such as a valid driver’s license, passport, or other government-issued identification. Once you have filled out the form, you must sign and date it, and then submit it to the appropriate agency.

What is the purpose of bi form cgaf 001?

The purpose of the Bi Form CGAF 001 is to provide a secure, web-based system for the collection and management of information related to a business's customers, suppliers, partners, and other stakeholders. The form is used to create and maintain records of customer and supplier information, as well as other important information related to the business. It also serves as a centralized system of communication between the business and their stakeholders.

What information must be reported on bi form cgaf 001?

BI Form CGAF 001, also known as the Customer Due Diligence (CDD) Form, is a questionnaire that must be completed by financial institutions in the Philippines to gather necessary information about their customers for anti-money laundering and counter-terrorism financing purposes.

The following information must be reported on BI Form CGAF 001:

1. Personal Information:

- Full name

- Gender

- Nationality

- Date of birth

- Place of birth

- Marital status

- Mobile/contact number

2. Identification Information:

- Type of identification document (passport, driver's license, etc.)

- Identification document number

- Date of issuance

- Country of issuance

- Expiry date

3. Current Address:

- Complete address

- Postal code

- Country

4. Employment Information:

- Occupation

- Position

- Name of employer

- Business address

- Nature of business or industry

5. Financial Information:

- Monthly income

- Source of funds

- Estimated or actual net worth

- Purpose of the transaction

6. Declaration:

- Confirming the accuracy and truthfulness of the information provided

- Acknowledgment of potential legal consequences for providing false or misleading information

It's important to note that the specific information required may vary, depending on the nature of the customer and the type of account or transaction being conducted. Additionally, additional documentation or supporting evidence may also be required to verify the information provided on the form.

How do I modify my ph cgaf001 application in Gmail?

philippines bureau cgaf001 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit cgaf 001 consolidated general form in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing philippines cgaf001 consolidated and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit philippines cgaf001 application on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit philippines application immigrant visa.

What is PH BI Form CGAF-001?

PH BI Form CGAF-001 is a form used for reporting information to the Philippine Bureau of Internal Revenue regarding certain transactions and activities that may affect tax liabilities.

Who is required to file PH BI Form CGAF-001?

Individuals and entities engaged in business activities that meet specific thresholds or requirements set by the Bureau of Internal Revenue are required to file PH BI Form CGAF-001.

How to fill out PH BI Form CGAF-001?

To fill out PH BI Form CGAF-001, follow the instructions provided by the Bureau of Internal Revenue, ensuring to input accurate and complete information in the required fields, including financial details and other pertinent data.

What is the purpose of PH BI Form CGAF-001?

The purpose of PH BI Form CGAF-001 is to provide the Bureau of Internal Revenue with necessary information for assessing compliance with tax regulations and calculating potential tax liabilities.

What information must be reported on PH BI Form CGAF-001?

The information that must be reported on PH BI Form CGAF-001 includes details such as income earned, expenses incurred, applicable taxes withheld, and any other significant transactions relevant to tax assessment.

Fill out your PH BI Form CGAF-001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Philippines Application Immigrant Visa Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.